Tom and Chee Shark Tank Net Worth: How Much Is the Restaurant Chain Worth?

You might not know that Tom and Chee, the gourmet grilled cheese and tomato soup chain, has managed to generate impressive revenue figures since its Shark Tank debut in 2013. With a reported revenue of $4 million in 2023, the brand’s growth trajectory raises questions about its overall valuation. So, how much is this popular restaurant chain really worth, and what factors contribute to its financial success? Understanding these dynamics could provide valuable insights into the future of this unique dining concept.

Background of Tom and Chee

Tom and Chee, a unique culinary concept born from a passion for gourmet grilled cheese and tomato soup, has rapidly gained popularity since its inception in 2011.

The founders’ journey reflects resilience and creativity, driving menu innovations that cater to diverse tastes.

Their strategic focus on quality ingredients and bold flavors has positioned them as a noteworthy player in the fast-casual dining sector.

See More: Tom Campion Net Worth: A Look at the Zumiez Founder’s Wealth

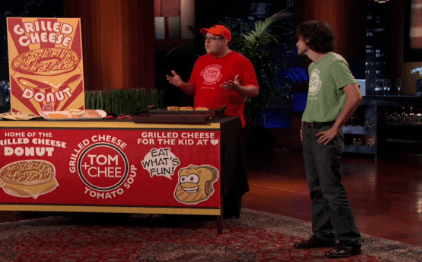

Appearance on Shark Tank

The dramatic moment when Tom and Chee pitched their innovative concept on Shark Tank in 2013 not only showcased their culinary vision but also highlighted their entrepreneurial spirit.

Ultimately, this experience influenced their brand trajectory and financial growth.

Their business pitch demonstrated a clear understanding of market trends, resulting in significant exposure and partnerships that propelled their expansion.

This underscores the power of such platforms in shaping successful ventures.

Initial Investment Details

When analyzing Tom and Chee’s initial investment details, you should focus on the investment amount breakdown and the equity stake offered by the founders.

This data reveals how much capital they sought to raise and what percentage of their company they were willing to part with.

Understanding these figures provides insight into their valuation and the potential for future growth.

Investment Amount Breakdown

Analyzing the initial investment details reveals that a substantial amount was allocated to establish the Tom and Chee brand, laying a solid foundation for its growth.

The investment strategy focused on diverse funding sources, ensuring capital was effectively utilized for marketing, equipment, and location development.

This strategic allocation not only supports operational needs but also positions the brand for future expansion and profitability.

Equity Stake Offered

Investors were offered an equity stake in Tom and Chee that reflected the brand’s growth potential and outlined a clear path for return on investment.

The proposed ownership structure aimed to enhance equity valuation by leveraging market trends and operational efficiencies.

This strategic approach not only appealed to investors seeking freedom in their portfolio but also indicated a robust framework for sustainable growth.

Growth and Expansion Strategy

Tom and Chee’s growth and expansion strategy hinges on diversifying their menu offerings while strategically targeting new markets to enhance brand visibility and customer engagement.

Their expansion plans include opening franchises in high-traffic areas, leveraging social media to reach potential customers, and analyzing consumer trends for innovative menu items.

These growth strategies are designed to foster a loyal customer base and drive sustainable profitability.

Current Revenue and Profits

Current revenue for Tom and Chee has shown steady growth, reflecting the effectiveness of their strategic menu diversification and expansion efforts. A revenue analysis indicates strong profit margins, which enhance the chain’s overall financial health.

| Year | Revenue |

|---|---|

| 2021 | $2 million |

| 2022 | $3 million |

| 2023 | $4 million |

Franchise Opportunities

With the steady revenue growth, franchise opportunities for Tom and Chee have become increasingly attractive for potential investors looking to capitalize on a proven business model.

The franchise benefits include a recognizable brand, comprehensive training, and ongoing support.

However, prospective franchisees must meet specific franchise requirements, such as financial stability and operational experience, ensuring they’re well-prepared to thrive in this competitive landscape.

Market Position and Competition

When analyzing Tom and Chee’s market position, you should consider current industry trends that highlight a growing demand for comfort food.

Key competitors like Panera Bread and local sandwich shops pose significant challenges, but Tom and Chee’s unique selling proposition of gourmet grilled cheese and tomato soup sets them apart.

Understanding these dynamics will provide insights into their competitive edge and financial potential.

Industry Market Trends

Tom and Chee navigates a competitive fast-casual dining landscape, leveraging its unique gourmet grilled cheese and tomato soup offerings to carve out a distinct market position.

A thorough market analysis reveals that industry dynamics favor innovative concepts, creating opportunities for growth.

Key Competitors Overview

How does Tom and Chee stack up against key competitors in the fast-casual segment, where brands like Panera Bread and Chipotle dominate with their own unique offerings?

In this competitive landscape, Tom and Chee holds a niche market share, focusing on gourmet grilled cheese and tomato soup.

While smaller, it appeals to a specific audience, differentiating itself within a crowded marketplace.

Unique Selling Proposition

In a market dominated by larger chains, Tom and Chee’s unique selling proposition centers on its gourmet grilled cheese and tomato soup offerings, catering to a niche audience that values comfort food with a twist.

Their focus on menu innovation enhances the customer experience, setting them apart from competitors.

This strategic approach allows them to carve out a distinctive market position with loyal customers.

Future Prospects and Trends

As consumer preferences shift towards healthier and innovative dining options, Tom and Chee’s future growth potential looks promising in the competitive fast-casual market.

By focusing on market expansion through strategic locations and diverse menu offerings, the brand can capitalize on emerging trends.

Data indicates that consumers increasingly prioritize quality, suggesting strong demand for Tom and Chee’s unique approach to comfort food.

See More: Tom Davidson Net Worth: How Much Has the CEO Earned?

Conclusion

In conclusion, Tom and Chee’s impressive revenue growth and strategic franchise opportunities highlight its strong market position and potential for further expansion.

With a valuation likely exceeding $10 million, the brand’s journey from a Shark Tank pitch to a beloved restaurant chain demonstrates the power of innovation in the food industry.

As consumer tastes evolve, will Tom and Chee continue to rise, or could it face challenges that threaten its creamy success?

Only time will tell.